Start by creating your investment thesis.

It all begins with a succinct clear alignment to the overall business strategy and maturity – the time spent in drawing this framework will help save so much time and avoid creating multiple presentations down the road which then attempts to connect the dots.

Treat your data transformation as an investment portfolio. You can’t really put all your eggs in one basket, but you can decide on where you hedge your bets. Every business is constantly fine tuning their business operations and also have transformation teams that are also trying to radically change the business. Plan for both of these but consider the level of change that the firm can handle alongside the appetite for risk.

Your investment thesis (1) really sets the rhythm and excitement. There are many frameworks to document this - don’t get lost by trying to get this perfect. Pick a published framework out there and start collating the information. McKinsey published the “Next Operating Model for a Digital World” that provides a great heat map that you can use to determine the opportunities against impacts for the various companywide initiatives. I use a variation of this that has business questions attached to help companies get this on paper. You really determine how long this takes and how much help you need to flush this out. If you are treating this as an acquisition opportunity and have your senior leaders engaged, you should be able to construct the first draft in less than 4 weeks.

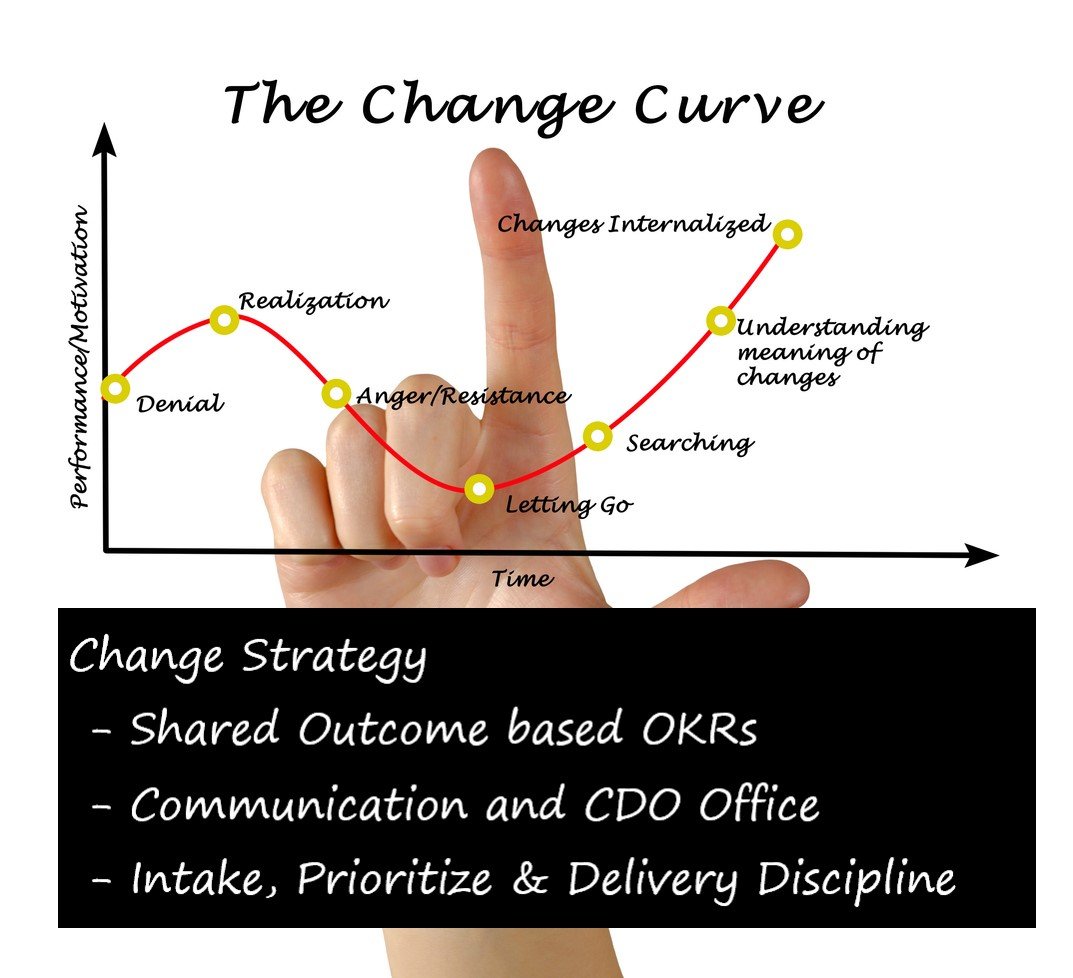

Plan your change strategy in line with your risk appetite.

Gartner recently published an article calling out that culture and data literacy are two major roadblocks in firms to truly unlock the value of data. Whilst treating data as an asset is often spoken about, the reality is that there is lack of data standards, common processes and appetite to share data, collaborate and create a true high value data asset that can be monetized. In some cases, it can take months to just create common definitions of a client or asset class.

Run your data initiatives like an investment portfolio

Create different pods to run your business operations optimization, diversification and foundational activities. These will all require focus and will have different timing of intersection and thus important to provide the delivery teams the structure to operate efficiently.

Data 101.

Get started with some of the foundational data building blocks. These are dependent on the investment thesis and change strategy but some of these activities can be initiated. Leverage the journey and experience of others in these when tackling these elements. Each of these areas are also advancing and changing. Get your build vs partner strategy right before trying to reinvent everything so that you can get ahead on focusing on your company’s core competencies.

Summary:

Data Transformation Ingredients.

To create your perfect data dish, build your data roadmap by considering:

Your investment thesis:

Business Operations

Diversification

Current Change Management Maturity and Acceleration Appetite

Change Strategy

Shared Outcome based OKRs

Communication and CDO Office

Intake, Prioritize and Delivery

Portfolio Management Execution Discipline

Data 101

Talent Strategy

Data Team Structure

Modern Data Platform

Data-Business Architecture

Data Risk and Regulation

Call me to talk more about getting more ROI from the sea of data out there! I am happy to share my templates and guide you through the process.